Barista FIRE is my favourite variation of FIRE and becoming increasingly popular. It’s clear financial independence is not a one size fits all approach which is why variations of FIRE have developed. There are three key stages to this approach

1) Wealth accumulation

2) Semi-retirement

3) Full retirement

In this article we will discuss:

- The definition of Barista FIRE

- How much money you need for Barista FIRE including how to calculate your Barista FI number

- Who Barista FI is best suited for including the advantages and disadvantages

- The difference between Barista FIRE and Coast FIRE

- Tips for achieving Barista FIRE

Now let’s get into it!

NOTICE: The content of this article is not to be considered as a legal opinion, financial advice or tax advice. Millionaire Wealth Guide does not hold itself out as a legal, financial or tax advisor. If you want to receive a legal opinion or tax advice on the matter in this article please contact us directly and we will refer you to a legal practitioner.

What is Barista FIRE?

Barista FIRE is an approach to financial independence where your living costs are covered by both investment income and a part-time job or side hustle, the exact proportion of which you decide.

Unlike traditional FIRE, you save and invest until you reach your Barista FIRE number to draw some passive income from your investments which is used to fill the gap between your required living expenses and income expected from a part-time job or side hustle.

A key advantage of Barista FIRE is that it is quicker to achieve than traditional FIRE (sometimes by a lot!) while still allowing you to enjoy a significantly enhanced work-life balance and freedom.

The timeline of Barista FIRE would typically require working full-time for a relatively short period of time e.g. 10 years and then switching to part-time work or a side hustle to supplement core living expenses. It’s therefore clear that rather than retiring early in a traditional FIRE sense, Barista FIRE is effectively a semi-retirement strategy which many of the same advantages.

Who should pursue Barista FIRE?

- Those wanting a taste of FIRE extra early

- Those who have side hustle income and happy to continue pursuing that avenue

- Those who can consider working part-time

- Those living in countries with health insurance

I would challenge those on their FIRE journey as to whether full retirement is truly their end goal or whether escaping the rat race and corporate 9-5 is the priority. For me, I have no intention of stopping work completely and have confidence in my ability to generate a passive income from side hustles and businesses. Therefore,

How do you calculate your Barista FIRE number?

To calculate FIRE you simply multiply your annual expenses x 25 e.g. $60,000 x 25 = $1.5M when using the 4% withdrawal rule.

For Barista FIRE we need to account for your expected average income from a part-time job or side hustle in your semi-retirement period. This amount is then reduced from the annual living expenses number used in the traditional FIRE formula. For example, if you expect to earn $20k from a part-time job or side hustle your Barista FIRE number will be:

($60,000 – $20,000) * 25 = $1M.

Barista FIRE = (annual living expenses – annual income from a part-time job or side hustle) x 25

In this example, your Barista FIRE number is $500k less (33.3%) than the traditional FIRE number we calculated.

Benefits of Barista FIRE

A key benefit of Barista FIRE is that it gives you an early taste of FIRE because simply put, your FIRE number will be significantly lower and more achievable.

The reason I believe it is such an exciting FIRE philosophy is because it’s a form of FIRE that is more realistic. For example, I would question whether someone in their 30’s or even 40’s truly wants to never work again. I think instead there is a desire to be able to leave the corporate rat race and 9-5 daily grind which under the Barista FIRE would still be achieved. Working a part-time job or a side hustle is not the same as a full-time corporate gig, it just isn’t or at least it doesn’t have to be. For example, you could find a part-time job you are passionate about that may not be the most lucrative but still earns you enough to achieve Barista FIRE and be content. In any case, working in some capacity provides many benefits including a sense of purpose which some people in retirement claim they lose once they stop.

From a US perspective, when you have a part-time job it often though not always will provide you with health insurance benefits which can be a significant financial benefit. However, depending on the state you live, your income may qualify you for health insurance subsidies regardless.

Disadvantages of Barista FIRE

A key disadvantage of Barista FIRE is that there is still a need to work and subsidize your income which may place limits of the time and location freedom aspect of traditional FIRE.

Another disadvantage is that given the annual income from your part time job or side justle is subsidizing your semi-retirement, full retirement is unlikely to be reached until a traditional retirement age. However, this risk can be mitigated by earning more from your part-time salary, continuing to invest and also withdrawing less than 4% from your investment portfolio annually.

Barista FIRE vs Coast FIRE

Coast FIRE is a when you have contributed enough to your investment accounts that over time with the magic of compound interest will grow to the amount needed for “traditional” retirement.

In contrast with Barista FIRE, you are withdrawing from your investment portfolio much earlier (sometimes even decades earlier!) and working only part-time as opposed to full time. There is clearly a significant lifestyle difference.

Barista FIRE vs Traditional Retirement:

Traditional Retirement is when you work to the government / state pension age when your social security or government pension kick in. By then the idea is that you have saved enough in your retirement accounts to afford to step away from working for good.

In contrast with Barista FIRE, you are continuing to work up until old age when you hope to be able to enjoy the money you’ve saved and take a break. Barista FIRE therefore prioritizes enjoyment of life in the short-term through the taste of freedom it provides.

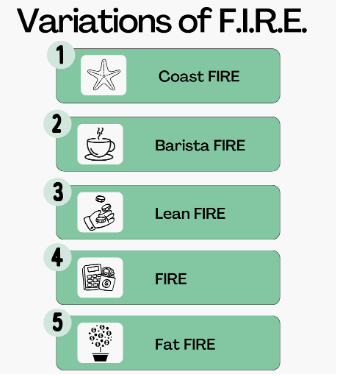

Different types of FIRE:

Shown below are all variations of FIRE from and where Barista FIRE fits into the mix:

For more detailed guides to each of these FIRE approaches and to see which one best suits your personal circumstances please refer to the linked articles below:

- Coast FIRE – in progress.

- Lean FIRE – in progress.

- FIRE – in progress.

- FAT FIRE – in progress.

Tips for achieving Barista FIRE:

- Ensure you can find a part-time job that will not only cover your bills beyond what your but will provide a meaningful improvement in the quality of your life vs your current 9-5. This is because you don’t want to leave your job only to find you hate your new part-time job because that would result in no lifestyle improvement.

- Like with any form of FIRE, there are huge advantages to investing early and often thanks to the magic of compound interest, Barista FIRE is no different.

- Make sure you have clarity over what your Barista FIRE number is and what assumptions underpin it. For example, be lazer focused on what income you need to ensure your expenses are covered each month. If you have extra consider putting this into investments.

- Permanent semi-retirement is not something that many people want, it is therefore, imperative to build in some assumptions around being able to permanently retire too. With that said, I typically recommend people earn above their ‘required’ Barista FIRE number and invest that difference to help provide a nest egg for the future. Its also just good practice so that you can cover any unexpected incidental costs life may throw at you.

Final thoughts on Barista FIRE

Barista FIRE is not suited for everyone, however, it does provide a taste of freedom much quicker than both a traditional FIRE approach and certainly a traditional retirement approach. It’s very important to gain clarity on your annual expenses and build in a buffer if possible in your income from your part-time job or side hustle.

For me Barista FIRE is very exciting because I am able to continue working on my businesses and dedicated the attention and energy they require. Ultimately it is an approach to FIRE that provides me with the freedom to achieve this and enjoy life to the fullest in terms of time at an early age. However, it must be mentioned that it does not represent full financial independence because there remains a need to work and this is not suited for everyone.