Coast FIRE is a form of financial independence that allows you to stop saving and investing but requires you to keep working until retirement age. The job you have needs to be enough to cover your annual expenses but no longer needs to include an amount for retirement saving and investing. As you continue to work at your job, your investments will be compounding over time and growing until you reach retirement age.

Compared to other forms of financial independence, Coast FIRE is the first milestone and easiest to hit. This is because as you will see when you calculated your Coast FIRE number that it is significantly below your traditional FIRE number. By the same token, it is the slowest way to achieve full financial independence.

NOTICE: The content of this article is not to be considered as a legal opinion, financial advice or tax advice. Millionaire Wealth Guide does not hold itself out as a legal, financial or tax advisor. If you want to receive a legal opinion or tax advice on the matter in this article please contact us directly and we will refer you to a legal practitioner.

What is Coast FIRE?

Coast FIRE is a form of financial independence where you have enough saved and invested for retirement by your chosen retirement age with the magic of compounding and assuming a 4% withdrawal rate.

An exciting aspect of Coast FIRE is that once you have achieved it, you only need to earn enough to cover your current expenses. By way of example, if you earn $100k from your job or side hustle and you were previously saving and investing 40% for retirement, you only need to earn $60k until you reach retirement age.

How to calculate your Coast FIRE number

In order to calculate Coast FIRE you need to first calculate your traditional FIRE number as follows based on the 4% rule. In the formula below I am also using a 7% return assumption to account for inflation as well as dividends being reinvested.

Step 1: Traditional FIRE number = Annual expenses x 25

Step 2: Coast FIRE number = FIRE number / (1 + Annual Rate of Return) ^ (time in years)

Example calculations:

Step 1: $60,000 x 25 = $1.5M

Step 2: $1.5M / (1 + 7%) ^ 25 = $276K

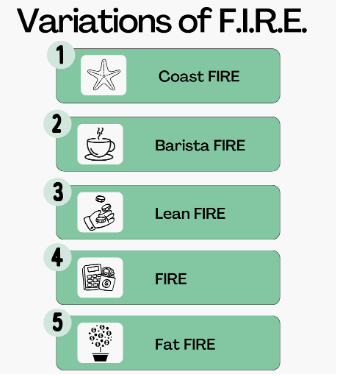

The difference in this example is $1.2M!For me this highlights why Coast FIRE is attractive to many people because fundamentally it is more accessible. Also, rather like a professional runner, setting their sights on incremental targets on a longer journey, Coast FIRE can act as a launchpad and motivator to achieve higher levels of FIRE like Barista FIRE, Lean Fire, FIRE and even Fat FIRE.

What is the difference between Coast FIRE and Barista FIRE?

A key difference between Barista FIRE and Coast FIRE is that Barista FIRE allows you to work part-time and have more flexibility in the type of work you choose. Typically, Barista FIRE is associated with leaving a 9-5 corporate role and working in a role part-time that you are more passionate about or even find simply more relaxing. The part-time job or side hustle just needs to cover your basic day-to-day expenses beyond what your 4% withdrawal will cover.

With Coast FIRE the focus is instead on not needing to save anything further for retirement specifically. In turn this allows you to coast in your career because you income only needs to cover your current cost of living and some level of savings as opposed to needing to incorporate investing for retirement too.

What Coast FIRE and Barista FIRE have in common is that they are at the lower end of the FIRE freedom pyramid and still require some level of work. In that sense, these FIRE approaches are not for everyone.

Advantages and disadvantages of Coast FIRE

The advantage of Coast FIRE is that is motivating and exciting to know that you have enough invested that you can in theory invest not a single dollar more into your retirement accounts. Another advantage is that Coast FIRE represents the lowest barrier of all FIRE approaches to achieve.

The disadvantages of Coast FIRE however include the risk that if your return on investment after inflation is only 6% but you calculated your Coast FIRE number on 8% there will be a gap. The same can be said from your investment withdrawal rate e.g. if you take funds out during retirement to pay for a one off emergency and its higher than the 4% withdrawal rate you assumed there will also be a gap.

I personally believe Coast FIRE is a great first step in your financial journey and a motivator, however, it is for many not an end goal and frankly not so dissimilar from regular employees contributing to their retirement accounts. One big distinction is the fact you can choose to no longer contribute.

Different variations of FIRE:

Shown below are all variations of FIRE from and where Barista FIRE fits into the mix:

For more detailed guides to each of these FIRE approaches and to see which one best suits your personal circumstances please refer to the linked articles below:

- Coast FIRE – in progress.

- Lean FIRE – in progress.

- FIRE – in progress.

- FAT FIRE – in progress.

Tips for successfully achieving Coast FIRE

- Be clear on your Coast FIRE number and assumptions used including your investment growth rate (accounting for inflation) and

- Set an achievable budget to ensure you are able to invest early and often to achieve your Coast FIRE number by your target age

- The earlier you save and invest the faster you will hit your Coast FIRE number thanks to the magic of compound interest!

- Realize that Coast FIRE is for many the first milestone of their FIRE journey

Final thoughts on Coast FIRE

Coast FIRE is an exciting step into the world of FIRE and represents a key milestone. It should once achieved provide you with a sense of accomplishment and even freedom that hopefully motivates you towards achieving Barista FIRE, Lean FIRE, FIRE, or even Fat FIRE! I personally do not consider it in any way an end-goal because Coast FIRE still does require you to work until you reach retirement age. In that sense there isn’t truly financial independence until a normal retirement age, and for many with this approach you won’t be retiring especially early. But as I mentioned before, treat this as a key steppingstone into the FIRE area, you’ll thank yourself for doing so!

To achieve Coast FIRE it helps to as always start saving and investing as early as possible so you can reach your target investment amount before letting the magic of compound interest kick in! This involves setting a clear budget, calculating your Coast FIRE number and being clear on the assumptions you have used to determine that number.