What is Lean FIRE? A minimalist approach to saving and investing

Lean FIRE is an exciting variation of FIRE that focuses on achieving FIRE as soon as possible, ideally in your 30’s and 40’s! Central to Lean FIRE is the idea of frugality because living a lower cost of living allows you to maximize your savings and investments to achieve FIRE sooner. It requires an understanding of what your basic needs are and minimizing spending.

When people calculate their traditional FIRE number it is typically based on a budget that is comfortable, for example, a certain amount set for entertainment. What Lean FIRE does is set a bottom’s up bare bones budget that covers your living essentials.

With Lean FIRE it is important to firstly understand what in life you truly care about. For example, if you like very expensive things like big homes, fancy cars, and Rolex watches, this approach to FIRE is not for you. Alternatively, if you are more minimalist in your approach to finances and frugal this could be the perfect option for you. Undoubtedly there is sacrifice in this approach to FIRE, namely there is minimal cushion for enjoying life’s luxuries, financially at least. However, there is a significant upside which is the opportunity to achieve financial independence very early!

Traditional FIRE = Annual expenses x 25 and Lean FIRE has the same formula however your annual expenses in the equation will be significantly lower. By way of example:

Traditional FIRE = $80k x 25 = $2M

Lean FIRE = $40k x 25 = $1M

At the heart of Lean FIRE is a philosophy of being happy with less and to some extent minimalism. By being happy with a less is more approach to life, the annual expenses amount needed in your FIRE formula and in turn FIRE number will naturally be lower.

Advantages of the Lean FIRE approach:

- Fast track to achieving a meaningful form of financial independence

- More achievable than traditional FIRE

- Great for those people who naturally live a more frugal lifestyle

- Great approach for those able to benefit from geoabitrage particularly internationally and making their dollars go further

Disadvantages of the Lean FIRE

- Lifestyle sacrifice

- Frugal living and minimalism is not for everyone

- Harder to achieve when living in a high cost of living area

- Harder to achieve with dependents

Tips for achieving Lean FIRE:

- Avoid lifestyle creep like the plague

- Don’t opt for life’s biggest expenses including big homes, cars, and expensive weddings

- Consider house hacking

- Live in a lower cost of living place and consider geoarbitrage which is where you use your money in a lower cost of living location so that your money goes further. This could be in the US or abroad.

- Don’t fall victim to high interest anything

- Minimize dependents

- Consider living with friends or family to fast track your investments from a younger age

- Own of your home and avoid renting (not essential though)

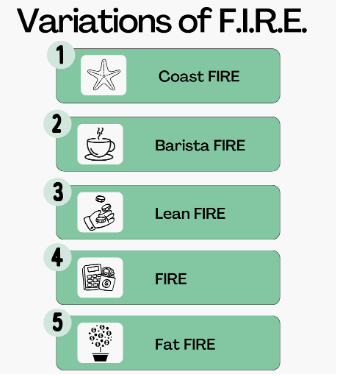

Different types of FIRE:

Shown below are all variations of FIRE from and where Barista FIRE fits into the mix:

For more detailed guides to each of these FIRE approaches and to see which one best suits your personal circumstances please refer to the linked articles below:

- Coast FIRE – in progress.

- Lean FIRE – in progress.

- FIRE – in progress.

- FAT FIRE – in progress.

Final thoughts on Lean FIRE:

Lean FIRE certainly has its merits, undeniably. For the right individual or couple it represents a very exciting way to achieve FIRE early. Unlike Barista FIRE I think that Lean FIRE does truly represent a form of financial independence because you can walk away from your job once your Lean FIRE number has been achieved. I personally think achieving Lean FIRE provides a significant uplift in your financial security and there is always the option once achieved to get to the next milestones of Traditional FIRE and even Fat FIRE thoughts it not required.